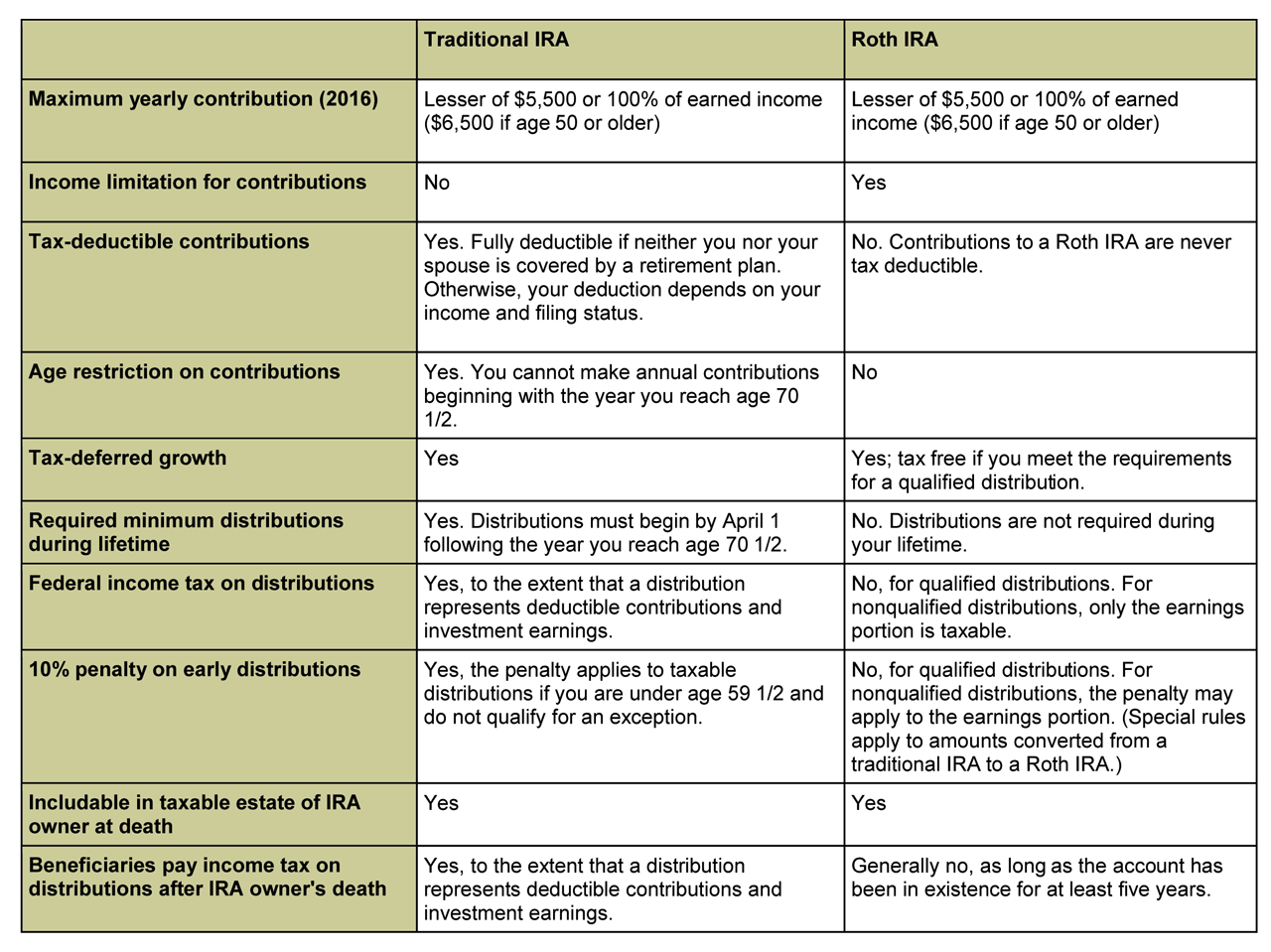

It can be a regular annual contribution or a conversion contribution.Įxample 1: Earliest Date for Qualified Withdrawals The five-year period for determining if you pass the five-year test begins on January 1 of the first tax year for which you make a Roth contribution. However, you must pass both the age 59 1/2 test and the five-year test to be eligible for qualified withdrawals. As such, they are automatically federal-income-tax-free and penalty-tax-free.

Then, all withdrawals from any of your Roth accounts are qualified withdrawals. Have had at least one Roth IRA open for over five years.Are at least age 59 1/2 (or disabled or dead) and.Here's what you need to know about Roth withdrawals and taxes. Qualified acquisition costs are defined as those spent to acquire, construct, or reconstruct a principal residence - including closing costs. The home buyer (and the buyer's spouse if the buyer is married) must not have owned a principal residence within the two-year period that ends on the acquisition date. Your spouse's child, grandchild, or grandparent.Your child, grandchild, or grandparent or.

The principal residence can be purchased by: In other words, it is free from federal income tax and penalties. To the extent the special rule applies to a withdrawal, the eligible amount is treated as a qualified withdrawal. However, there is a $10,000 lifetime limit on this special rule. To qualify, you must spend the money within 120 days to pay qualified principal residence acquisition costs. Special Home Buyer Rule for Those Under Age 59 1/2Īfter you've passed the five-year test described in this article, a special rule allows federal-income- tax-free and penalty-free Roth withdrawals for some home buyers. On top of that, withdrawals before age 59 1/2 can potentially get hit with a 10% premature withdrawal penalty tax. Y ou may think that all withdrawals from Roth IRAs are federal-income-tax-free.

0 kommentar(er)

0 kommentar(er)